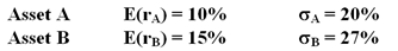

Two assets have the following expected returns and standard deviations when the risk-free rate is 5%:  An investor with a risk aversion of A = 3 would find that ________ on a risk-return basis.

An investor with a risk aversion of A = 3 would find that ________ on a risk-return basis.

A) only Asset A is acceptable

B) only Asset B is acceptable

C) neither Asset A nor Asset B is acceptable

D) both Asset A and Asset B are acceptable

Correct Answer:

Verified

Q13: The arithmetic average of -11%,15% and 20%

Q21: Treasury notes are paying a 4% rate

Q25: You have an EAR of 9%. The

Q25: The rate of return on _ is

Q25: Your investment has a 20% chance of

Q27: If you require a real growth in

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents