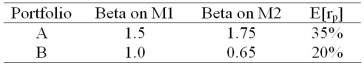

There are two independent economic factors M1 and M2.The risk-free rate is 5% and all stocks have independent firm-specific components with a standard deviation of 25%.Portfolios A and B are well diversified.Given the data below which equation provides the correct pricing model?

A) E(rP) = 5 + 1.12 P1 + 11.86 P2

B) E(rP) = 5 + 4.96 P1 + 13.26 P2

C) E(rP) = 5 + 3.23 P1 + 8.46 P2

D) E(rP) = 5 + 8.71 P1 + 9.68 P2

Correct Answer:

Verified

Q64: The expected return on the market is

Q71: Research has identified two systematic factors that

Q72: If the simple CAPM is valid and

Q73: Assume that both X and Y are

Q75: Using the index model,the alpha of a

Q77: According to the CAPM,what is the expected

Q78: You run a regression of a stock's

Q79: A stock has a beta of 1.3.The

Q80: The expected return on the market portfolio

Q81: The measure of risk used in the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents