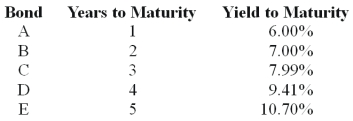

Consider the following $1,000 par value zero-coupon bonds:  The expected one-year interest rate four years from now should be _________.

The expected one-year interest rate four years from now should be _________.

A) 16.00%

B) 18.00%

C) 20.00%

D) 22.00%

Correct Answer:

Verified

Q42: Which of the following bonds would most

Q43: You purchased a 5-year annual interest coupon

Q44: $1,000 par value zero coupon bonds, ignore

Q46: A bond has a par value of

Q48: A coupon bond pays semi-annual interest is

Q49: A callable bond pays annual interest of

Q50: A coupon bond which pays interest semi-annually

Q51: A coupon bond which pays interest annually,has

Q52: $1,000 par value zero coupon bonds, ignore

Q59: Yields on municipal bonds are typically _

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents