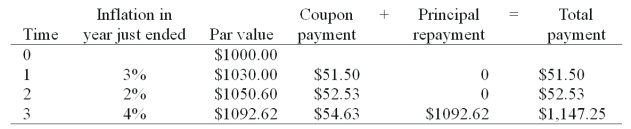

Consider a newly issued TIPS bond with a three year maturity, par value of $1000, and a coupon rate of 5%. Assume annual coupon payments.

-What is the real rate of return on the TIPS bond in the first year?

A) 5.00%

B) 8.15%

C) 7.15%

D) 4.00%

Correct Answer:

Verified

Q65: A bond has a flat price of

Q67: The yield to maturity of an 10-year

Q68: If the quote for a Treasury bond

Q69: A discount bond that pays interest semiannually

Q70: On May 1, 2007, Joe Hill is

Q71: One,two and three year maturity,default-free,zero-coupon bonds have

Q72: A corporate bond has a 10-year maturity

Q74: On May 1, 2007, Joe Hill is

Q76: Assuming semiannual compounding,a 20-year zero coupon bond

Q77: A 6% coupon U.S.treasury note pays interest

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents