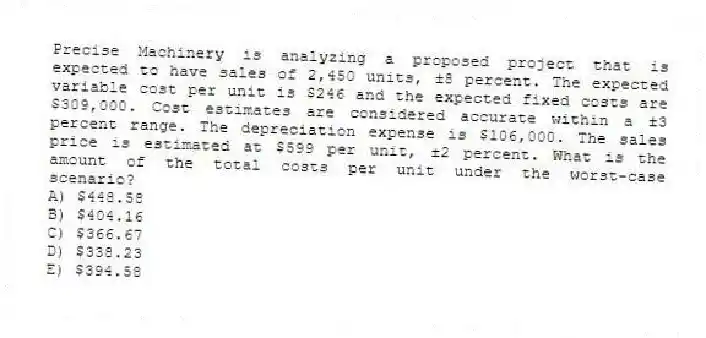

Precise Machinery is analyzing a proposed project that is expected to have sales of 2,450 units, ±8 percent. The expected variable cost per unit is $246 and the expected fixed costs are $309,000. Cost estimates are considered accurate within a ±3 percent range. The depreciation expense is $106,000. The sales price is estimated at $599 per unit, ±2 percent. What is the amount of the total costs per unit under the worst-case scenario?

A) $448.58

B) $404.16

C) $366.67

D) $338.23

E) $394.58

Correct Answer:

Verified

Q44: By definition, which one of the following

Q45: You are considering a project and are

Q46: Which one of the following is the

Q47: Operating leverage is the degree of dependence

Q48: Which one of the following will best

Q50: Assume both the discount and tax rates

Q51: Precise Machinery is analyzing a proposed project.

Q52: New Town Instruments is analyzing a proposed

Q53: Assume a project has a discounted payback

Q54: PC Enterprises wants to commence a new

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents