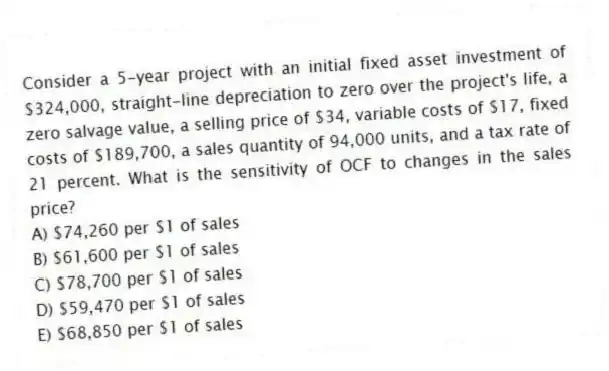

Consider a 5-year project with an initial fixed asset investment of $324,000, straight-line depreciation to zero over the project's life, a zero salvage value, a selling price of $34, variable costs of $17, fixed costs of $189,700, a sales quantity of 94,000 units, and a tax rate of 21 percent. What is the sensitivity of OCF to changes in the sales price?

A) $74,260 per $1 of sales

B) $61,600 per $1 of sales

C) $78,700 per $1 of sales

D) $59,470 per $1 of sales

E) $68,850 per $1 of sales

Correct Answer:

Verified

Q66: Precise Machinery is analyzing a proposed project

Q67: Shoe Supply has decided to produce a

Q68: Your company is reviewing a project with

Q69: Stellar Plastics is analyzing a proposed project

Q70: You are considering a new product launch.

Q72: The Creamery is analyzing a project with

Q73: A project has an accounting break-even point

Q74: At the accounting break-even point, Swiss Mountain

Q75: The accounting break-even production quantity for a

Q76: Assume a project has a sales quantity

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents