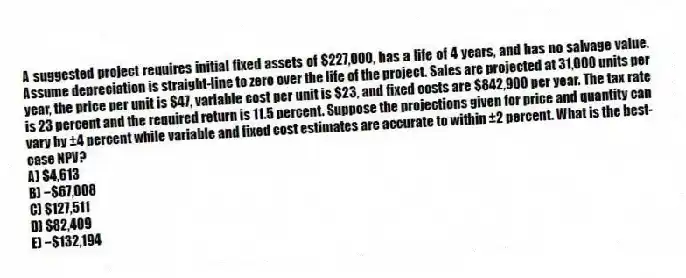

A suggested project requires initial fixed assets of $227,000, has a life of 4 years, and has no salvage value. Assume depreciation is straight-line to zero over the life of the project. Sales are projected at 31,000 units per year, the price per unit is $47, variable cost per unit is $23, and fixed costs are $842,900 per year. The tax rate is 23 percent and the required return is 11.5 percent. Suppose the projections given for price and quantity can vary by ±4 percent while variable and fixed cost estimates are accurate to within ±2 percent. What is the best-case NPV?

A) $4,613

B) −$67,008

C) $127,511

D) $82,409

E) −$132,194

Correct Answer:

Verified

Q75: The accounting break-even production quantity for a

Q76: Assume a project has a sales quantity

Q77: A proposed project has fixed costs of

Q78: The Metal Shop produces 1.7 million metal

Q79: HiLo Mfg. is analyzing a project with

Q81: Cool Shades manufactures biotech sunglasses. The variable

Q82: A proposed project has fixed costs of

Q83: The accounting manager of Gateway Inns has

Q84: The Coffee Express has computed its fixed

Q85: Spencer Tools would like to offer a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents