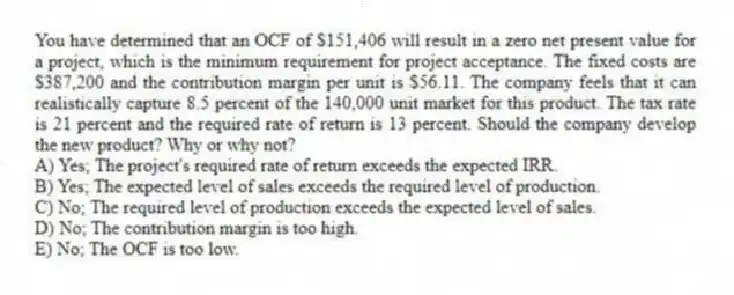

You have determined that an OCF of $151,406 will result in a zero net present value for a project, which is the minimum requirement for project acceptance. The fixed costs are $387,200 and the contribution margin per unit is $56.11. The company feels that it can realistically capture 8.5 percent of the 140,000 unit market for this product. The tax rate is 21 percent and the required rate of return is 13 percent. Should the company develop the new product? Why or why not?

A) Yes; The project's required rate of return exceeds the expected IRR.

B) Yes; The expected level of sales exceeds the required level of production.

C) No; The required level of production exceeds the expected level of sales.

D) No; The contribution margin is too high.

E) No; The OCF is too low.

Correct Answer:

Verified

Q89: A project has an accounting break-even quantity

Q90: You are the manager of a project

Q91: A project has an estimated sales price

Q92: A company is considering a project with

Q93: Steele Insulators is analyzing a new type

Q95: A project has a unit price of

Q96: At an output level of 22,500 units,

Q97: The Motor Works is considering an expansion

Q98: A project has a contribution margin per

Q99: Mountain Gear can manufacture mountain climbing shoes

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents