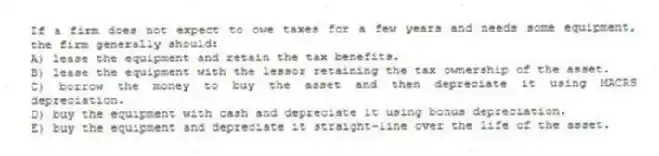

If a firm does not expect to owe taxes for a few years and needs some equipment, the firm generally should:

A) lease the equipment and retain the tax benefits.

B) lease the equipment with the lessor retaining the tax ownership of the asset.

C) borrow the money to buy the asset and then depreciate it using MACRS depreciation.

D) buy the equipment with cash and depreciate it using bonus depreciation.

E) buy the equipment and depreciate it straight-line over the life of the asset.

Correct Answer:

Verified

Q7: Kate is leasing some equipment from Ajax

Q8: Maria has a fully amortized 10-year lease

Q9: Which one of the following does not

Q10: If a lessor borrows money from a

Q11: Brentwood Industries is selling its tool and

Q13: A financial lease in which the lessor

Q14: Which one of the following statements is

Q15: Beginning in 2019, operating leases will be

Q16: A financial lease:

A) usually requires the lessor

Q17: If a firm enters a sale and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents