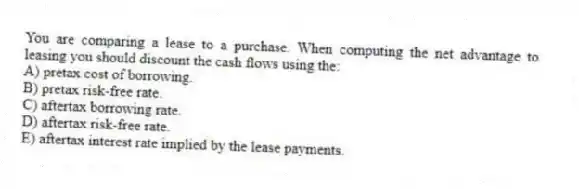

You are comparing a lease to a purchase. When computing the net advantage to leasing you should discount the cash flows using the:

A) pretax cost of borrowing.

B) pretax risk-free rate.

C) aftertax borrowing rate.

D) aftertax risk-free rate.

E) aftertax interest rate implied by the lease payments.

Correct Answer:

Verified

Q16: A financial lease:

A) usually requires the lessor

Q17: If a firm enters a sale and

Q18: A leveraged lease is a:

A) lease where

Q19: A firm that is cyclical in nature

Q20: A financial lease:

A) is generally called a

Q22: Lester's is analyzing a purchase versus a

Q23: Assume a lessor and a lessee can

Q24: Jamestown Supply is considering leasing some equipment

Q25: What does the IRS require if lease

Q26: Which one of these is considered to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents