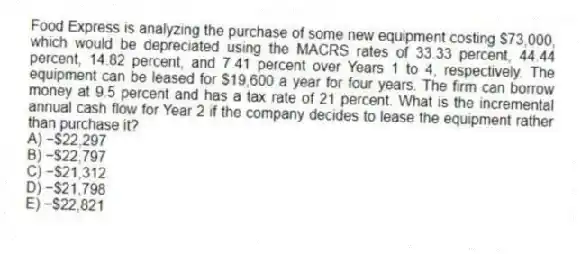

Food Express is analyzing the purchase of some new equipment costing $73,000, which would be depreciated using the MACRS rates of 33.33 percent, 44.44 percent, 14.82 percent, and 7.41 percent over Years 1 to 4, respectively. The equipment can be leased for $19,600 a year for four years. The firm can borrow money at 9.5 percent and has a tax rate of 21 percent. What is the incremental annual cash flow for Year 2 if the company decides to lease the equipment rather than purchase it?

A) −$22,297

B) −$22,797

C) −$21,312

D) −$21,798

E) −$22,821

Correct Answer:

Verified

Q48: A lessor will charge $30,500 a year

Q49: National Rail can purchase equipment for $386,000

Q50: Pizza Shoppes is considering either leasing or

Q51: Steven's Auto is trying to decide whether

Q52: The Box Store is considering the purchase

Q54: Cayman Productions is considering either leasing or

Q55: You work for a nuclear research laboratory

Q56: Rosewood Furniture is considering purchasing equipment costing

Q57: Do-Rite Construction is evaluating the lease versus

Q58: A lessor will charge $13,800 a year

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents