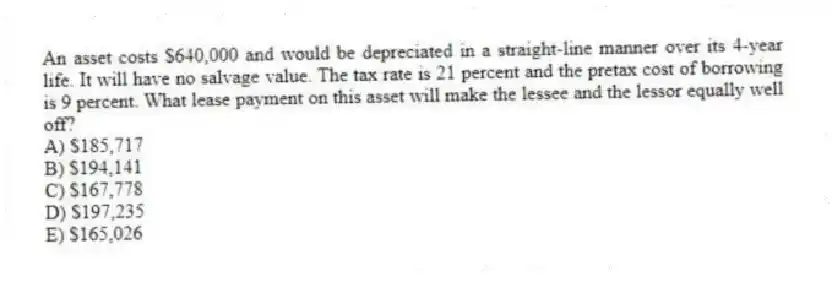

An asset costs $640,000 and would be depreciated in a straight-line manner over its 4-year life. It will have no salvage value. The tax rate is 21 percent and the pretax cost of borrowing is 9 percent. What lease payment on this asset will make the lessee and the lessor equally well off?

A) $185,717

B) $194,141

C) $167,778

D) $197,235

E) $165,026

Correct Answer:

Verified

Q59: Business Services needs some office equipment costing

Q60: A firm can either lease or buy

Q61: If your firm purchases a machine costing

Q62: Wildcat Oil Company is trying to decide

Q63: A scanner that costs $2.8 million would

Q65: A machine costs $2.2 million and would

Q66: Frank's Auto can purchase new equipment for

Q67: A machine that will be worthless after

Q68: Turner's has decided to modernize its production

Q69: CT Motors borrows money at 8.35 percent,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents