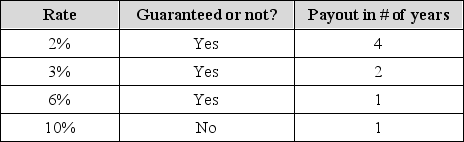

An investor is faced with a decision of investing $5,000. The investor is in no hurry to cash in on their gains and is considered risk-averse. Which option should they choose?

A) The 2% rate, because it is the longest payout

B) The 3% rate

C) The 6% rate, because it is the highest guaranteed return

D) The 10% rate, because the risk is worth the higher return

E) Either the 2% rate or the 6% rate, as they both offer the same total return

Correct Answer:

Verified

Q20: _ is a state of uncertainty where

Q21: Recent news about fires due to droughts

Q22: Which of the following is an example

Q23: Which of the following is an example

Q24: Which of the following statements is true?

A)

Q26: Discuss three reasons why people tend to

Q27: Compare and contrast the following scenario in

Q28: Describe perceived risk and give an example.

Q29: According to psychologists, people tend to be

Q30: Categorize the following people in relation to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents