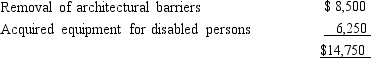

Golden Corporation is an eligible small business for purposes of the disabled access credit.During the year, Golden makes the following expenditures on a structure originally placed in service in 1988.

In addition, $8,000 was expended by Golden on a building originally placed in service in the current year to ensure easy accessibility by disabled individuals.Calculate the amount of the disabled access credit available to Golden Corporation.

In addition, $8,000 was expended by Golden on a building originally placed in service in the current year to ensure easy accessibility by disabled individuals.Calculate the amount of the disabled access credit available to Golden Corporation.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q21: During the year, Green, Inc., incurs the

Q22: Cardinal Company incurs $800,000 during the year

Q30: Waltz, Inc., a U.S. taxpayer, pays foreign

Q47: Several years ago, Sarah purchased a certified

Q61: Black Company paid wages of $180,000, of

Q63: In March 2018, Gray Corporation hired two

Q64: Which, if any, of the following correctly

Q71: Amber is in the process this year

Q89: Explain the purpose of the tax credit

Q93: Steve records a tentative general business credit

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents