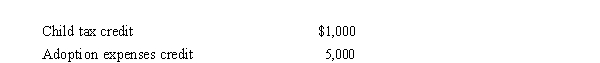

Prior to the effect of the tax credits, Justin's regular income tax liability is $200,000.and his tentative minimum tax is $195,000.Justin reports the following credits.  Calculate Justin's tax liability after credits.

Calculate Justin's tax liability after credits.

A) $190,000

B) $194,000

C) $195,000

D) $200,000

Correct Answer:

Verified

Q27: The standard deduction is allowed for regular

Q29: Kay claimed percentage depletion of $119,000 for

Q32: Interest on a home equity loan cannot

Q42: On February 1, 2018, Omar acquires used

Q44: Which of the following statements is correct?

A)If

Q46: Marvin, the vice president of Lavender, Inc.,

Q47: For regular income tax purposes, Yolanda, who

Q51: For individual taxpayers, the AMT credit is

Q52: Dale owns and operates Dale's Emporium as

Q55: In 2018, Glenn recorded a $108,000 loss

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents