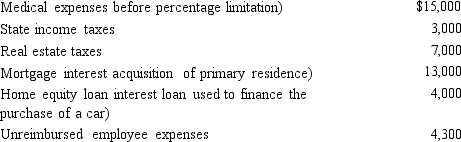

Mitch, who is single and age 46 and has no dependents, had AGI of $100,000 this year.His potential itemized deductions were as follows.  What is the amount of Mitch's AMT adjustment for itemized deductions for 2018?

What is the amount of Mitch's AMT adjustment for itemized deductions for 2018?

A) $10,000.

B) $12,300.

C) $16,300.

D) $34,300.

Correct Answer:

Verified

Q53: Celia and Christian, who are married filing

Q65: In 2018, Liam's filing status is married

Q68: Tamara operates a natural gas sole proprietorship

Q72: In the current tax year for regular

Q80: Brenda correctly has calculated her regular tax

Q90: Melinda is in the 35% marginal regular

Q92: What is the purpose of the AMT

Q107: In calculating her taxable income, Rhonda, who

Q108: Ted, who is single, owns a personal

Q110: What is the relationship between taxable income

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents