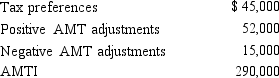

Use the following selected data to calculate Devon's taxable income.Devon itemizes deductions.

Correct Answer:

Verified

Q61: In 2018, Brenda has calculated her regular

Q67: Which of the following would not cause

Q84: Do AMT adjustments and AMT preferences increase

Q86: Why does Congress see a need for

Q93: What is the relationship between the regular

Q97: When qualified residence interest exceeds qualified housing

Q98: If a taxpayer deducts the standard deduction

Q117: Tad and Audria, who are married filing

Q124: Andrea, will not itemize deductions in calculating

Q134: A taxpayer has a passive activity loss

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents