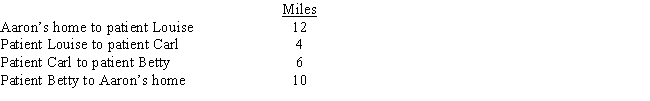

Aaron is a self-employed practical nurse who works out of his home. He provides nursing care for disabled persons living in their residences. During the day he drives his car as follows.  Aaron's deductible mileage for each workday is:

Aaron's deductible mileage for each workday is:

A) 10 miles.

B) 12 miles.

C) 20 miles.

D) 22 miles.

E) 32 miles.

Correct Answer:

Verified

Q41: By itself, credit card receipts will not

Q56: When contributions are made to a traditional

Q62: In which, if any, of the following

Q64: When using the automatic mileage method, which,

Q65: Dave is the regional manager for a

Q67: Employees who render an adequate accounting to

Q69: For self-employed taxpayers, travel expenses are not

Q71: Statutory employees:

A)Report their expenses on Form 2106.

B)Include

Q74: A worker may prefer to be treated

Q77: Aiden performs services for Lucas. Which, if

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents