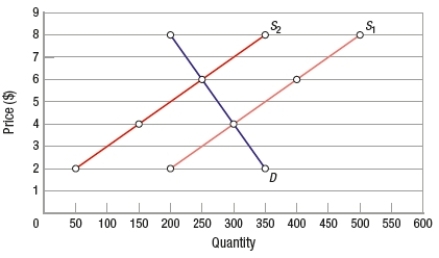

(Figure: Determining Tax Burdens) Based on the graph, the tax incidence

A) is zero.

B) falls more heavily on consumers.

C) falls more heavily on producers.

D) cannot be determined from the given information.

Correct Answer:

Verified

Q241: Tax incidence describes

A) who makes the tax

Q242: The economic burden of a tax borne

Q243: A tax on a product

A) has no

Q244: Tax incidence usually falls

A) only on consumers.

B)

Q245: (Figure: Determining Tax Burdens) Based on the

Q247: A sales tax applied to a specific

Q248: Suppose the demand for toxic waste disposal

Q249: Suppose the demand for toxic waste disposal

Q250: The economist Henry George proposed that all

Q251: The economist Henry George proposed that all

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents