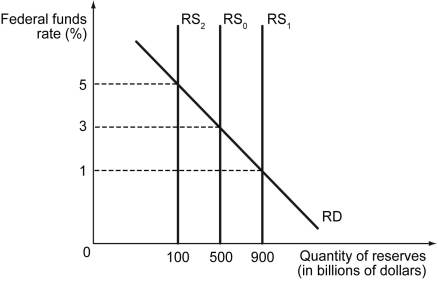

Scenario: The following figure shows the federal funds market. Assume that the market of reserves is in equilibrium at $500 billion in reserves and a 3 percent federal funds rate.

-Refer to the scenario above.If the Fed completes an open market sale of bonds that changes the quantity of reserves by $400 billion,then the federal funds rate will ________.

A) increase to 5 percent

B) decrease to 1 percent

C) remain at 3 percent

D) more information is needed to determine the new federal funds rate

Correct Answer:

Verified

Q36: The federal funds rate is the interest

Q37: The ultimate goal of an expansionary monetary

Q38: The economy is in a recession.The Fed

Q39: If long-term interest rates fall,_.

A) unemployment increases

B)

Q40: If the central bank wants to reduce

Q42: On a graph,if the x-axis measures the

Q43: If the Fed wants to decrease the

Q44: If the Fed wants to increase the

Q45: Scenario: The following figure shows the federal

Q46: Which of the following happens if the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents