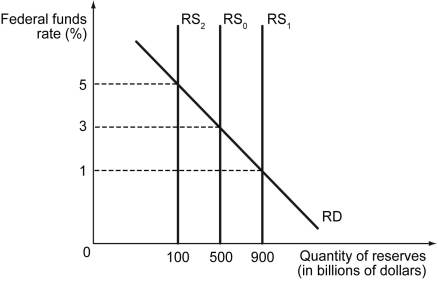

Scenario: The following figure shows the federal funds market. Assume that the market of reserves is in equilibrium at $500 billion in reserves and a 3 percent federal funds rate.

-Refer to the scenario above.Suppose the Fed wants to raise the federal funds rate by 2 percent.To do this,the Fed will have to ________.

A) sell $400 billion worth of bonds to a private bank

B) sell less than $400 billion worth of bonds to a private bank

C) buy $400 billion worth of bonds from a private bank

D) buy less than $400 billion worth of bonds from a private bank

Correct Answer:

Verified

Q55: If the Fed buys bonds from a

Q56: Scenario: The following figure shows the federal

Q57: Scenario: The following table shows the initial

Q58: Open market operations refer to the Fed's

Q59: Scenario: The following figure shows the federal

Q61: When does the Fed lend through the

Q62: Scenario: The following table shows the initial

Q63: Quantitative easing is likely to lead to

Q64: Which of the following is likely to

Q65: Scenario: The following table shows the initial

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents