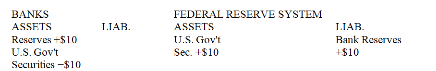

Table 13-1

EFFECTS OF AN OPEN MARKET TRANSACTION ON THE BALANCE SHEETS OF BANKS AND THE FED (In millions of dollars)

-After the transaction in Table 13-1 is completed, what happens to actual reserves, required reserves, and excess reserves?

Assume the required reserve ratio is 25 percent.

A) Actual reserves increase by $10 million, required reserves increase $2.5 million, and excess reserves increase by $7.5 million.

B) Actual reserves decrease by $10 million, required reserves decrease $2.5 million, and excess reserves decrease by $7.5 million.

C) Actual reserves increase by $10 million, required reserves are unchanged, and excess reserves increase by $10 million.

D) Actual reserves decrease by $10 million, required reserves decrease by $10 million, and excess reserves are unchanged.

Correct Answer:

Verified

Q103: Which of the following is correct?

A)The Fed

Q104: Which of the following is the most

Q105: Q105: The Fed relies on open-market operations, which Q107: The Fed conducts an open-market purchase of Q112: If the Fed sells a T-bill to Q114: The tool most frequently relied on by Q116: When the Fed purchases government securities from Q118: When the Fed wants to expand the Q119: If the Fed sells a T-bill to

![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents