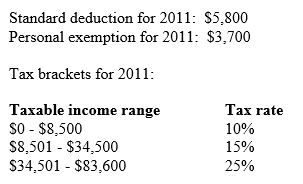

Bang Nguyen recently graduated from college and started working in a good job. He has a little money invested in a stock that pays no dividends. He lives in an apartment, is single, and has no dependents. He has a $22,000 student loan balance and he paid $600 interest in 2011. He is considering going back to school part-time for some additional computer classes. He does not have a personal IRA and he contributed 2% of his $38,750 salary to his 401K plan at work for 2011. He is just completing his tax return for 2011. Based on the information below, answer the following questions.

-Based on Bang's completed tax return, what advice would you give him to lower his tax liability for 2012?

A) He should definitely take the computer classes in 2012.

B) He should sell his stock.

C) He should increase his contribution to his 401K plan at work.

D) He should get a roommate and claim him as a dependent.

E) Both A and C are good advice.

Correct Answer:

Verified

Q57: Which factors affect your choice between claiming

Q59: Which of the following are permissible itemized

Q60: Janet and her husband, Bob, are facing

Q61: For many years Andy paid someone else

Q65: For many years Andy paid someone else

Q66: Katarina and Richard are a busy young

Q77: Your base income tax liability can be

Q84: What is the Bajorshiks' adjusted gross income?

A)$98,712

B)$97,212

C)$96,747

D)$95,247

E)$83,462

Q100: Although Richard and Katarina are a happily

Q109: Name and describe the four general categories

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents