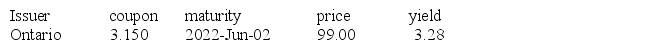

Given the following bond information:

What would be the taxable income on this bond if it were purchased at this price on June 1st and sold December 1st for a price of 103.00 and has face value of $20 000 and a semi-annual coupon payment?

A) Taxable capital gain of $800 and interest of $630.

B) Taxable capital gain of $400 and interest of $315.

C) Taxable capital gain of $1600 and interest of $656.

D) Taxable capital gain of $200 and interest of $157.50.

Correct Answer:

Verified

Q62: When there is an element of default

Q64: Which of the following bond quotes might

Q68: The risk that you will be forced

Q69: Other things being equal,in general,which of the

Q72: If the bond market expects a 10

Q73: Jan buys a $1000 10 percent semi-annual

Q75: Michael decided to buy a strip bond

Q76: Bonds with a high degree of default

Q77: Your son will be ready for college

Q80: If you buy a corporate bond for

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents