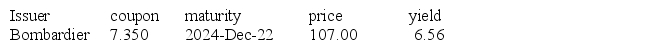

Given the following bond information:

What would be the taxable income on this bond if it were purchased at this price on December 20th and sold a year later for a price of 103.00? Assume face value of $10 000 and a semi-annual coupon payment.

A) Taxable capital gain of $400 and interest of $735

B) Taxable capital loss of $400 and interest of $735

C) Taxable capital loss of $200 and interest of $735

D) Taxable capital gain of $200 and interest of $656

Correct Answer:

Verified

Q42: Given the following ATT Ltd.bond information: $1000

Q49: If a company anticipates a substantive decline

Q53: One difference between a regular bond and

Q56: Bonds that may be exchanged for common

Q60: Which of the following is the greatest

Q63: Investing in bonds based on interest rate

Q74: You expect interest rates to rise in

Q75: Michael decided to buy a strip bond

Q76: Bonds with a high degree of default

Q77: Your son will be ready for college

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents