Use the information below to answer the following questions.

On December 31, 2017, Reagan Inc. signed a lease with Silver Leasing Co. for some equipment having a seven-year useful life. The lease payments are made by Reagan annually, beginning at signing date. Title does not transfer to the lessee, so the equipment will be returned to the lessor on December 31, 2023. There is no purchase option, and Reagan guarantees a residual value to the lessor on termination of the lease.

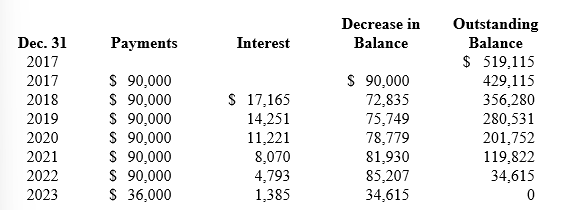

Reagan's lease amortization schedule appears below:

-What is the balance of the lease liability on Reagan's December 31, 2019, balance sheet (after the third lease payment is made) ?

A) $280,531.

B) $190,530.

C) $266,280.

D) $356,280.

Correct Answer:

Verified

Q28: Use the information below to answer the

Q29: Use the information below to answer the

Q30: Use the information below to answer the

Q31: If the lessor records deferred rent revenue

Q32: Technoid Inc. sells computer systems. Technoid leases

Q34: The appropriate asset value reported in the

Q35: Technoid Inc. sells computer systems. Technoid leases

Q36: Advance payments made by the lessee on

Q37: Which of the following statements characterizes an

Q38: Of the five criteria for a finance

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents