On January 1, 2018, Wellburn Corporation leased an asset from Tabitha Company. The asset originally cost Tabitha $300,000. The lease agreement is an operating lease that calls for four annual payments beginning on January 1, 2018, in the amount of $36,000. The other three remaining payments will be made on January 1 of each subsequent year. Which of the following journal entries should Tabitha record on January 1, 2018?

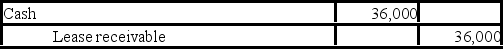

A)

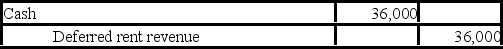

B)

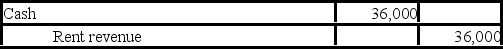

C)

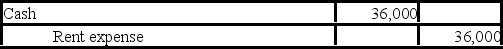

D)

Correct Answer:

Verified

Q35: Technoid Inc. sells computer systems. Technoid leases

Q36: Advance payments made by the lessee on

Q37: Which of the following statements characterizes an

Q38: Of the five criteria for a finance

Q39: A short-term lease:

A) Must be accounted for

Q41: Refer to the following lease amortization schedule.

Q42: Refer to the following lease amortization schedule.

Q43: Refer to the following lease amortization schedule.

Q44: Refer to the following lease amortization schedule.

Q45: Refer to the following lease amortization schedule.

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents