On January 1, 2018, Calloway Company leased a machine to Zone Corporation. The lease qualifies as a sales-type lease. Calloway paid $240,000 for the machine and is leasing it to Zone for $34,000 per year, an amount that will return 10% to Calloway. The present value of the lease payments is $240,000. The lease payments are due each January 1, beginning in 2018. What is the appropriate interest entry on December 31, 2018?

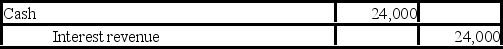

A)

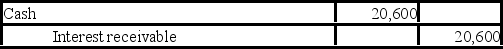

B)

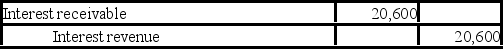

C)

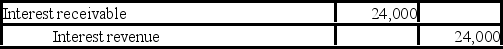

D)

Correct Answer:

Verified

Q69: The costs that (a) are associated directly

Q70: The costs that (a) are associated directly

Q71: A noncancelable lease contains an option to

Q72: If the residual value of a leased

Q73: ABC Company leased equipment to Best Corporation

Q75: Which of the following statements regarding lessee-guaranteed

Q76: What are the three types of expenses

Q77: Francisco leased equipment from Julio on December

Q78: The lessee's option to purchase a leased

Q79: Durney Co. recorded a right-of-use asset of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents