Merlin Co. leased equipment to Houdini Inc. The equipment cost the lessor $200,000. The appropriate interest rate for this lease is 15%. The annual lease payments are made at the end of each year. The lease term is three years. The residual value at the end of the lease term is expected to be $40,000. Houdini has the option to purchase the equipment at that time for $20,000. Assume this is a sales-type lease without selling profit. Round your answers to the nearest whole dollar amounts.  Required:

Required:

1. For this lease:

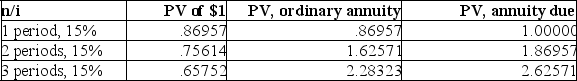

(a) The lease payment computed by the lessor is $________.

(b) The amount the lessee should record as an asset is $________.

2. How much interest should be recognized at the end of year 1 by the:

(a) Lessor? $________

(b) Lessee? $________

Correct Answer:

Verified

Q126: Here is a lease amortization schedule for

Q127: The Bobo Company leased equipment from Bolinger

Q128: Neely BBQ leased equipment from Smoke Industries

Q129: Scape Corp. manufactures telephony equipment. Scape leased

Q130: On June 30, 2018, Blue, Inc. leased

Q132: Peridot Leasing entered into an agreement to

Q133: Rumsfeld Corporation leased a machine on

Q134: Rumsfeld Corporation leased a machine on

Q135: Kate Co. leased a warehouse from Big

Q136: Southwestern Edison Company leased equipment from Hi-Tech

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents