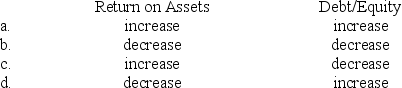

Star Corp. has a rate of return on assets of 10% and a debt/equity ratio of 2 to 1 before entering into an operating lease. Not including any indirect effects on earnings, when Star Corp. records the operating lease, the immediate impact on these ratios is a(an) :

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer:

Verified

Q210: Omega leased a machine for a ten-year

Q211: The costs that (a) are associated directly

Q212: The costs that (a) are associated directly

Q213: A lessee will reassess variable lease payments

Q214: On January 1, Smith Industries leased equipment

Q216: If the leaseback portion of a sale-leaseback

Q217: Bird leased equipment that had a retail

Q218: The costs that (a) are associated directly

Q219: On January 1, Ramirez Supply leased a

Q220: If the leaseback portion of a sale-leaseback

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents