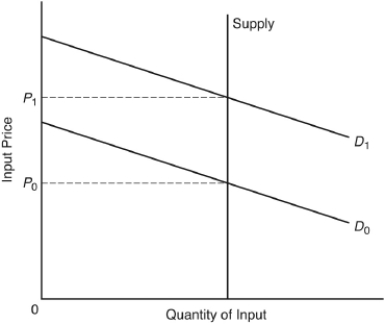

The following question are based on the following diagram, representing the supply and demand curves for an input:

-If the demand curve is D₀,a tax on the income received by the supplier of this input

A) increases the demand to D₁.

B) reduces the quantity sold of the input.

C) raises the quantity sold of the input.

D) raises the equilibrium price of the input.

E) has no effect on the equilibrium price and quantity of the input.

Correct Answer:

Verified

Q48: Economic rent is a

A) payment above the

Q49: Among the factors giving rise to profits

Q50: Schumpeter argued that

A) rents should be taxed

Q51: Approximately what percent of the gross domestic

Q52: If the supply of an input is

Q54: Profits

A) are the largest component of GDP.

B)

Q55: The view that the only tax governments

Q56: The price of an input,fixed in supply,its

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents