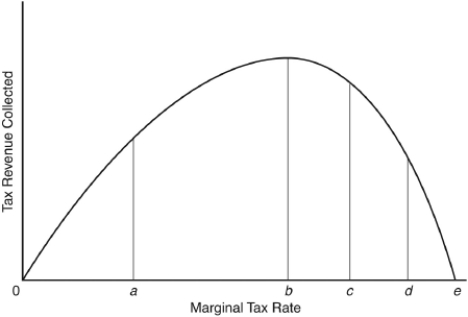

The following question are based on the following Laffer curve:

-Advocates of supply-side tax reductions,such as a reduction in the capital gains tax,argue that these taxes currently have marginal tax rates that are

A) 0.

B) to the left of 0a.

C) between 0a and 0b.

D) to the right of 0b.

E) greater than 0e.

Correct Answer:

Verified

Q46: To produce a rightward shift in the

Q47: Inflationary pressures may be lessened with measures

Q48: According to supply-side economists,noninflationary policies to expand

Q49: Which of the following would be the

Q50: Supply-side measures pushed through Congress by the

Q52: The best example of the influences of

Q53: In the video,Nariman Behravesh argued that the

Q54: The argument that the primary impact of

Q55: The Laffer curve

A) shows the relationship between

Q56: In the Stagflation video,economist Laffer argued that

A)

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents