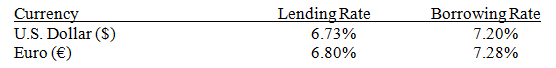

Assume the following information regarding U.S.and European annualized interest rates:

Milly Bank can borrow either $20 million or €20 million.The current spot rate of the euro is $1.13.Furthermore,Milly Bank expects the spot rate of the euro to be $1.10 in 90 days.What is Milly Bank's dollar profit from speculating if the spot rate of the euro is indeed $1.10 in 90 days

A) $579,845.

B) $583,800.

C) $588,200.

D) $584,245.

E) $980,245.

Correct Answer:

Verified

Q2: Investors from Germany,the United States,and Britain frequently

Q5: Assume that British corporations begin to purchase

Q8: If inflation increases substantially in Australia while

Q9: Baylor Bank believes the New Zealand dollar

Q10: Assume that Swiss investors have francs available

Q12: If the U.S.and Japan engage in much

Q16: The equilibrium exchange rate of pounds is

Q18: In general, when speculating on exchange rate

Q42: If inflation in New Zealand suddenly increased

Q54: A large increase in the income level

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents