The following regression model was run by a U.S.-based MNC to determine its degree of economic exposure as it relates to the Australian dollar and Sudanese dinar (SDD) :

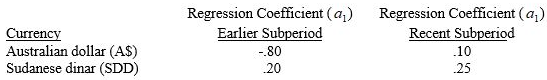

where the term on the left-hand side is the percentage change in inflation-adjusted cash flows measured in the firm's home currency over period , and is the percentage change in the exchange rate of the currency over period . The regression was run over two subperiods for each of the two currencies, with the following results:

Based on these results,which of the following statements is probably not true?

A) The MNC was more sensitive to movements in the Australian dollar than in the dinar in the earlier subperiod.

B) The MNC was more sensitive to movements in the dinar than in the Australian dollar in the more recent subperiod.

C) The MNC probably had more outflows than inflows in Australian dollars in the earlier subperiod.

D) The MNC probably had more inflows than outflows denominated in dinar in the more recent subperiod.

E) All of the above are true.

Correct Answer:

Verified

Q25: Dubas Co. is a U.S.-based MNC that

Q28: In general, a firm that concentrates on

Q34: Cerra Co.expects to receive 5 million euros

Q35: Volusia,Inc.is a U.S.-based exporting firm that expects

Q38: One argument for exchange rate irrelevance is

Q39: If an MNC has a net inflow

Q39: If the functional currencies for reporting purposes

Q44: One argument why exchange rate risk is

Q74: Which of the following is not a

Q89: If the U.S. dollar appreciates,

A) an MNC's

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents