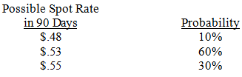

Assume that Jones Co.will need to purchase 100,000 Singapore dollars (S$) in 180 days. Today's spot rate of the S$ is $.50,and the 180day forward rate is $.53. A call option on S$ exists,with an exercise price of $.52,a premium of $.02,and a 180day expiration date. A put option on S$ exists,with an exercise price of $.51,a premium of $.02,and a 180day expiration date. Jones has developed the following probability distribution for the spot rate in 180 days:

The probability that the forward hedge will result in a higher payment than the options hedge is _______ (include the amount paid for the premium when estimating the U.S.dollars required for the options hedge) .

A) 0%

B) 10%

C) 30%

D) 40%

E) 70%

Correct Answer:

Verified

Q27: When a perfect hedge is not available

Q28: A call option exists on British pounds

Q34: You are the treasurer of Arizona Corporation

Q35: Assume that Kramer Co.will receive SF800,000 in

Q36: Money Corp.frequently uses a forward hedge to

Q40: Perkins Corp.will receive 250,000 Jordanian dinar (JOD)in

Q40: If interest rate parity (IRP) exists, then

Q42: A _ is not a technique for

Q42: If an MNC is hedging various currencies,

Q54: MNCs generally do not need to hedge

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents