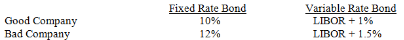

Good Company prefers variable to fixed rate debt.Bad Company prefers fixed to variable rate debt.Assume the following information for Good and Bad Companies:

Given this information:

A) an interest rate swap will probably not be advantageous to Good Company because it can issue both fixed and variable debt at more attractive rates than Bad Company.

B) an interest rate swap attractive to both parties could result if Good Company agreed to provide Bad Company with variable rate payments at LIBOR + 1% in exchange for fixed rate payments of 10.5%.

C) an interest rate swap attractive to both parties could result if Bad Company agreed to provide Good Company with variable rate payments at LIBOR + 1% in exchange for fixed rate payments of 10.5%.

D) none of the above

Correct Answer:

Verified

Q5: The yields offered on newly issued bonds

Q8: A U.S.firm has a Canadian subsidiary that

Q12: When ignoring exchange rate risk,bond yields:

A) are

Q13: An MNC issues ten-year bonds denominated in

Q15: If the currency denominating a foreign bond

Q15: Minnie Corp.has decided to issue three-year bonds

Q16: A U.S. firm has received a large

Q20: Assume a U.S.-based subsidiary wants to raise

Q28: If U.S. firms issue bonds in _,

Q38: _ are beneficial because they may reduce

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents