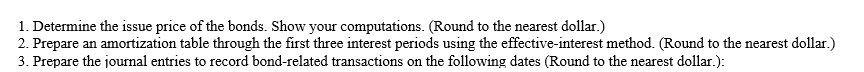

On April 1, 2011, Jenkins Corporation issued $500,000 of 10 percent, 5-year bonds at a yield of 12 percent compounded semiannually. Interest is payable on April 1 and October 1 of each year. The corporation is a calendar-year corporation. Bond premiums and discounts are amortized on interest-paying dates and at year-end. On October 1, 2012, Jenkins reacquired the bonds for retirement when they were selling at 99 on the open market (assume no call premium).

a. April 1, 2011

b. October 1,2011

c. December 31,2011

d. April 1, 2012

e. October 1,2012

Correct Answer:

Verified

Q102: On March 1, 2012, Lloyd Corporation sold

Q103: Use the present value and the future

Q104: Altus Company just borrowed $300,000 from its

Q105: On March 1, 2012, Enid Corporation borrowed

Q106: Use the present value and future value

Q108: On June 1, 2012, Bellamy Corporation borrowed

Q109: On January 1, 2011, Watters Corporation leased

Q110: On July 1, 2011, Meeker Corporation issued

Q111: Shidler Corporation reported the following data in

Q112: On January 1, 2011, Geary Corporation leased

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents