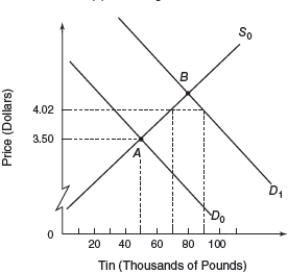

Figure 7.4 Global Market for Tin

-Consider the global market for tin represented by figure 7.4.Initially equilibrium is at point A with a market price of $3.50 per pound and 50,000 pounds.In ordr to keep tin price relatively stable an International Tin Agreement has set a price floor of $3.27 and a ceiling of $4.02.As the demand for tin increases to D1 how will the buffer-stock manager need to respond?

A) buy 10,000 pounds of tin

B) buy 20,000 pounds of tin

C) sell 10,000 pounds of tin

D) sell 20,000 pounds of tin

Correct Answer:

Verified

Q23: Once a cartel establishes its profit-maximizing price:

A)

Q29: A widely used indicator to differentiate developed

Q36: To be considered a good candidate for

Q41: All of the following nations except _

Q48: Figure 7.3. World Oil Market

Q50: For most developing countries:

A) Productivity is high

Q52: Figure 7.5 Global Market for Tin

Q59: The development of countries like South Korea

Q92: The majority of developing-nation exports are primary

Q98: The developing nations are most of those

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents