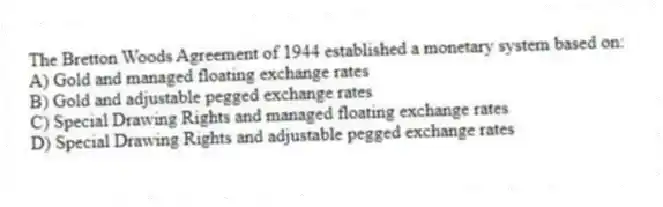

The Bretton Woods Agreement of 1944 established a monetary system based on:

A) Gold and managed floating exchange rates

B) Gold and adjustable pegged exchange rates

C) Special Drawing Rights and managed floating exchange rates

D) Special Drawing Rights and adjustable pegged exchange rates

Correct Answer:

Verified

Q8: Small nations (e.g.,Tanzania) with more than one

Q9: Rather than constructing their own currency baskets,many

Q10: Small nations (e.g.,the Ivory Coast) whose trade

Q11: Under adjustable pegged exchange rates,if the rate

Q12: Under a floating exchange-rate system,if American exports

Q14: Which exchange-rate system involves a "leaning against

Q15: Under a pegged exchange-rate system,which does not

Q16: A primary objective of dual exchange rates

Q17: During the 1970s,the European Union,in its quest

Q18: Which exchange-rate system does not require monetary

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents