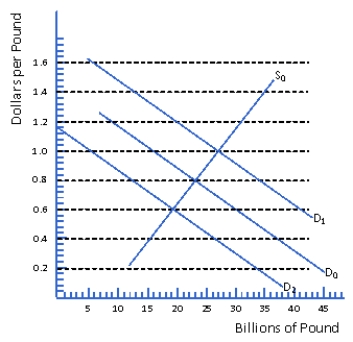

Figure 15.2 Market for the British Pound

-Refer to Figure 15.2.Suppose the demand for pounds increases from D0 to D1.Under a fixed exchange rate system,the U.S.exchange stabilization fund could maintain a fixed exchange rate of $0.80 per pound by:

A) Selling pounds for dollars on the foreign exchange market

B) Selling dollars for pounds on the foreign exchange market

C) Decreasing U.S.exports,thus decreasing the supply of pounds

D) Stimulating U.S.imports,thus increasing the demand for pounds

Correct Answer:

Verified

Q67: An objective of the dollarization of the

Q71: Exchange rate controls

A) Achieved prominence during the

Q80: The crawling peg is a

A) Fixed exchange

Q92: To keep the yen's exchange value from

Q104: Small nations, such as Angola and Barbados,

Q112: Many developing nations with low inflation rates

Q124: If Uganda revalues its shilling by 20

Q125: Most nations currently allow their currencies' exchange

Q137: The U.S.dollar is generally regarded as the

Q138: Because there is no exchange stabilization fund

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents