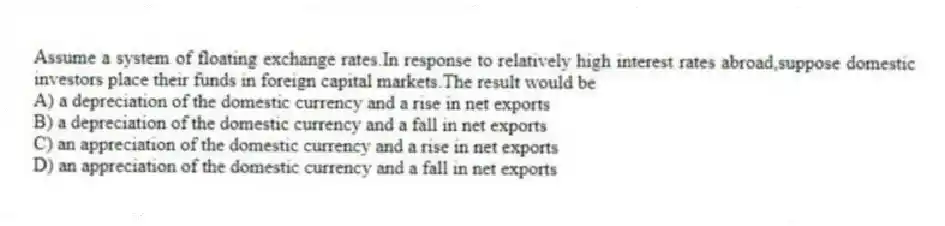

Assume a system of floating exchange rates.In response to relatively high interest rates abroad,suppose domestic investors place their funds in foreign capital markets.The result would be

A) a depreciation of the domestic currency and a rise in net exports

B) a depreciation of the domestic currency and a fall in net exports

C) an appreciation of the domestic currency and a rise in net exports

D) an appreciation of the domestic currency and a fall in net exports

Correct Answer:

Verified

Q20: Suppose Brazil faces domestic recession and a

Q21: Suppose a central bank prevents a depreciation

Q22: A system of floating exchange rates and

Q24: Exhibit 16.1

At the Plaza Accord of

Q26: Under a fixed exchange-rate system and high

Q27: Given an open economy with high capital

Q28: Under a system of managed-floating exchange rates

Q29: Under a fixed exchange-rate system and high

Q30: All of the following are obstacles to

Q34: At the _, the Group-of-Five nations agreed

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents