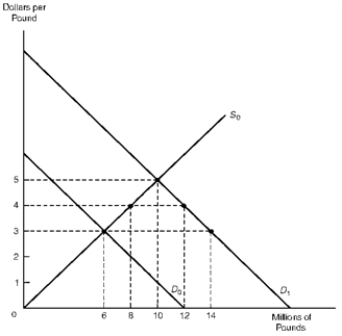

The diagram below represents the exchange market position of the United States in trade with the United Kingdom.Starting at the equilibrium exchange rate of $3 per pound,suppose the demand for pounds rises from D0 to D1.

Figure 17.1 Foreign Exchange Market

-Refer to Figure 17.1.Under a floating exchange rate system,the exchange rate would rise to $4 and U.S.monetary authorities would have to supply 4 million pounds to the foreign exchange market in exchange for dollars to maintain this rate.

Correct Answer:

Verified

Q37: Which indicator of international debt burden schedules

Q38: In response to the international debt problem,the

Q39: Debt reduction

A) Refers to any voluntary scheme

Q40: Bilateral agreements between central banks,which provide for

Q41: The diagram below represents the exchange market

Q43: International reserves allow a country to finance

Q44: When exchange rates are fixed by central

Q45: The demand for international reserves tend to

Q46: The demand for international reserves is negatively

Q47: With floating exchange rates,payments imbalances tend to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents