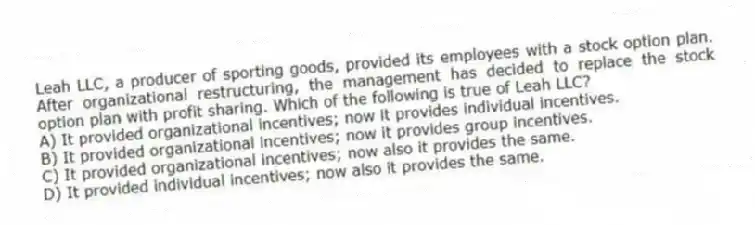

Leah LLC, a producer of sporting goods, provided its employees with a stock option plan. After organizational restructuring, the management has decided to replace the stock option plan with profit sharing. Which of the following is true of Leah LLC?

A) It provided organizational incentives; now it provides individual incentives.

B) It provided organizational incentives; now it provides group incentives.

C) It provided organizational incentives; now also it provides the same.

D) It provided individual incentives; now also it provides the same.

Correct Answer:

Verified

Q2: Which of the following statements is true

Q3: AirCar LLC, a producer of consumer electronics,

Q4: A differential piece-rate system pays employees_.

A) one

Q5: Which of the following is typically classified

Q6: Which of the following is an example

Q8: Variable pay is _.

A) compensation that is

Q9: Which of the following is true of

Q10: RedCat LLC, a footwear manufacturing company, practiced

Q11: Which of the following is a disadvantage

Q12: Team Spark LLC, a producer of consumer

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents