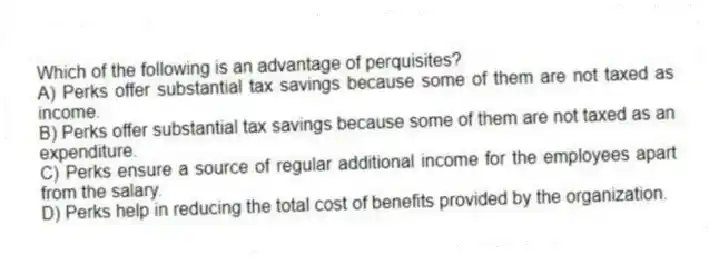

Which of the following is an advantage of perquisites?

A) Perks offer substantial tax savings because some of them are not taxed as income.

B) Perks offer substantial tax savings because some of them are not taxed as an expenditure.

C) Perks ensure a source of regular additional income for the employees apart from the salary.

D) Perks help in reducing the total cost of benefits provided by the organization.

Correct Answer:

Verified

Q53: _ are special benefits:usually noncash items:for executives.

A)

Q54: A significant portion of an executive's compensation

Q56: To ensure that spot bonuses works efficiently,

Q58: A differential piece-rate system pays employees one

Q60: Which of the following is typically classified

Q61: Supplemental benefit plans are plans that are

Q62: Thedifferential piece-rate system pays a flat rate

Q65: Under a straight piece-rate system, wages are

Q69: The most prevalent forms of organization-wide incentives

Q70: Nonfinancial rewards cannot be used as incentives

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents