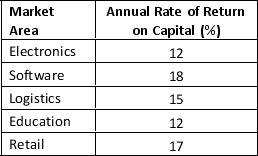

Northwest California Ventures Ltd. has decided to provide capital in five market areas for the start-ups. The investment consultant for the venture capital company has projected an annual rate of return based on the market risk, the product, and the size of the market.

The maximum capital provided will be $5 million.

The consultant has imposed conditions on allotment of capital based on the risk involved in the market.

• The capital provided to retail should be at most 40 percent of the total capital.

• The capital for education should be 26 percent of the total of other four markets (Electronics, Software, Logistics, and Retail)

• Logistics should be at least 15 percent of the total capital.

• The capital allocated for Software plus Logistics should be no more than the capital allotted for Electronics.

• The capital allocated for Logistics plus Education should not be greater than that allocated to Retail.

Calculate the expected annual rate of return based on the allocation of capital to each market area to maximize the return on capital provided. Also, show the allocation of capital for each market area.

Correct Answer:

Verified

x₂ = ...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q48: Michael has decided to invest $40,000 in

Q50: Ethan Steel, Inc. has two factories that

Q51: The supervisor of a production company is

Q52: A Cake & Pastry shop makes 3

Q53: A soft drink manufacturing company has 3

Q54: Jackson just obtained $240,000 by selling mutual

Q56: Clever Sporting Equipment, Inc. makes two types

Q57: A beverage cans manufacturer makes 3 types

Q58: Two mining fields, field A and field

Q60: Ethan Steel, Inc. has two factories that

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents