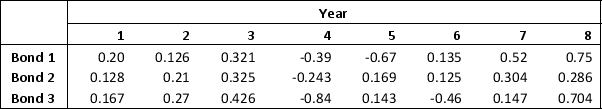

Consider the following data on the returns from bonds:

Develop and solve the Markowitz portfolio model using a required expected return of at least 15 percent. Assume that the 8 scenarios are equally likely to occur. Use this model to construct an efficient frontier by varying the expected return from 2 to 18 percent in increment of 2 percent and solving for the variance. Round all your answers to three decimal places.

Develop and solve the Markowitz portfolio model using a required expected return of at least 15 percent. Assume that the 8 scenarios are equally likely to occur. Use this model to construct an efficient frontier by varying the expected return from 2 to 18 percent in increment of 2 percent and solving for the variance. Round all your answers to three decimal places.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q31: The _ forecasting model uses nonlinear optimization

Q33: If the portfolio variance were equal to

Q36: Solving nonlinear problems with local optimal solutions

Q37: Reference - 10.2: Use the graph given

Q41: Roger is willing to promote and sell

Q43: Consider the return scenario for 3 types

Q44: Develop a model that minimizes semivariance for

Q45: Consider the objective function,

Q46: Consider the stock return data given below.

Q47: Jim is trying to solve a problem

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents