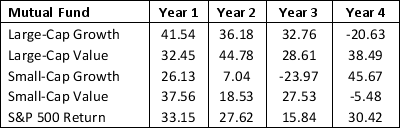

Consider the data on investment made in four types of funds and returns from S&P 500.

a. Develop an optimization model that will give the fraction of the portfolio to invest in each of the funds so that the return of the resulting portfolio matches as closely as possible the return of the S&P 500 Index. (Hint: Minimize the sum of the squared deviations between the portfolio's return and the S&P 500 Index return for each year in the data set.)

a. Develop an optimization model that will give the fraction of the portfolio to invest in each of the funds so that the return of the resulting portfolio matches as closely as possible the return of the S&P 500 Index. (Hint: Minimize the sum of the squared deviations between the portfolio's return and the S&P 500 Index return for each year in the data set.)

b. Solve the model developed in part a.

Correct Answer:

Verified

LG = proportion of portfolio inve...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q44: Develop a model that minimizes semivariance for

Q45: Consider the objective function,

Q46: Consider the stock return data given below.

Q47: Jim is trying to solve a problem

Q48: A Steel Manufacturing company has two production

Q50: Gatson manufacturing company is willing to promote

Q51: Consider the stock return data given below.

Q52: The profit function for two types

Q53: The manager of a supermarket estimates the

Q54: The exponential smoothing model is given

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents