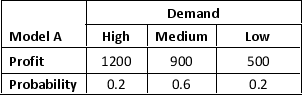

Visual Park is considering marketing one of its two television models for coming Christmas season: Model A or Model B. Model A is a unique featured television and appears to have no competition. Estimated profits (in thousand dollars) under high, medium, and low demand are given below:

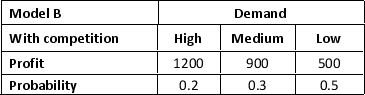

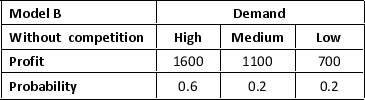

Visual Park is optimistic about the TV Model B. However, the concern is that profitability will be affected if a competitor launches a TV model which has similar features as Model B. Estimated profits (in thousand dollars) with and without competition is as follows:

a. Develop a decision tree for the Visual Park problem.

a. Develop a decision tree for the Visual Park problem.

b. For planning purposes, Visual Park believes there is a 0.7 probability that its competitor will launch a TV model similar to Model B. Given this probability of competition, the director of planning recommends marketing the Model A. Using expected value, what is your recommended decision?

c. Show a risk profile for your recommended decision.

d. Use sensitivity analysis to determine the probability of competition for Model B would have to be for you to change your recommended decision alternative.

Correct Answer:

Verified

b. EV(node 2) = 0.2(1200) + 0.6(90...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q45: Emil Hansen is interested in leasing a

Q46: Consider an advertising company which has to

Q47: The Golden Jill Mining Company is interested

Q48: A construction company must decide on the

Q49: Meega airlines decided to offer direct service

Q51: Consider a decision situation with four possible

Q52: The following payoff table shows the profit

Q53: A construction company must decide on the

Q54: Emil Hansen is interested in leasing a

Q55: A Manufacturing company introduces two product alternatives.

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents