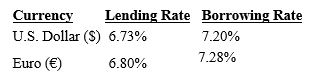

Assume the following information regarding U.S. and European annualized interest rates:

Trensor Bank can borrow either $20 million or €20 million. The current spot rate of the euro is $1.13. Furthermore, Trensor Bank expects the spot rate of the euro to be $1.10 in 90 days. What is Trensor Bank's dollar profit from speculating if the spot rate of the euro is indeed $1.10 in 90 days?

A) $579,845.

B) $583,800.

C) $588,200.

D) $584,245.

E) $980,245.

Correct Answer:

Verified

Q16: The real interest rate adjusts the nominal

Q19: _ are not a factor that causes

Q21: Any event that reduces the U.S. demand

Q28: Investors from Germany, the United States, and

Q44: The equilibrium exchange rate of pounds is

Q49: Assume that British corporations begin to purchase

Q53: The phrase "the dollar was mixed in

Q54: A large increase in the income level

Q60: Any event that increases the U.S. demand

Q68: Assume that the United States places a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents