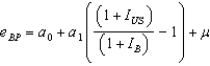

The following regression was conducted for the exchange rate of the British pound (BP) :

Regression results indicate that a₀ = 0 and a₁ = 2. Therefore,

A) purchasing power parity holds.

B) purchasing power parity overestimated the exchange rate change during the period under examination.

C) purchasing power parity underestimated the exchange rate change during the period under examination.

D) purchasing power parity will overestimate the exchange rate change of the British pound in the future.

Correct Answer:

Verified

Q1: According to purchasing power parity (PPP), if

Q3: According to the IFE, when the nominal

Q10: Purchasing power parity (PPP) focuses on the

Q15: The international Fisher effect (IFE) suggests that

Q18: Assume that inflation in the United States

Q19: If the international Fisher effect (IFE) holds,

Q20: Assume that the international Fisher effect (IFE)

Q51: Among the reasons that purchasing power parity

Q55: Assume that the U.S. one-year interest rate

Q57: Which of the following is not true

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents